In preparation for the June 1 hearing on the FY 2018 proposed budget generally and specifically the proposed $ .02 increase in the real estate tax rate, we're delving into the budget.

According to the proposed budget summary in the June 1 hearing advertisement (PDF), the FY 2018 budget will be $2.3 million greater than the FY 2017 approved budget. This represents an increase of 6.24%. Half the increase comes from the Estimated Beginning Undesignated General Fund Balance revenue category. An additional amount comes from the Board of Supervisors' proposed $ .02 increase in the real estate tax rate.

Other differences include:

The Wyoming Association of Municipalities aptly describes (PDF) the value of the narrative; see the image to the right. The organization also urges members to assess their budget document by asking four questions:

Lack of metrics: The budget proposed by the Board of Supervisors contains no data about anticipated service levels. This makes assessing the adequacy of budget categories and activities next to, if not entirely, impossible.

$ .02 increase in the real estate tax rate: With the increase, the General Property Taxes revenue is $19 million, a 707,125 or 3.85% increase over the approved FY 2017 revenue of $18.4 million. By comparison, the FY 2017 budgeted revenue was $1.2 million, or 7%, greater than the FY 2016 actual revenue of $17.2 million.

Several questions should be asked about this revenue source:

Contract with the YMCA: The YMCA requested an additional $50,000 for FY 2018, bringing their total contract with the county to $100,000. With no narrative, there is no explanation of what this money will do for county residents.

According to the proposed budget summary in the June 1 hearing advertisement (PDF), the FY 2018 budget will be $2.3 million greater than the FY 2017 approved budget. This represents an increase of 6.24%. Half the increase comes from the Estimated Beginning Undesignated General Fund Balance revenue category. An additional amount comes from the Board of Supervisors' proposed $ .02 increase in the real estate tax rate.

Other differences include:

- an additional $50,000 for the YMCA—doubling their FY 2017 appropriation

- an additional $149,325 for the Sheriff for an important records software purchase

- $100,000 for contractual services related to the reassessment

- a reduction across the board for unemployment insurance

Notable elements of the proposed budget

Lack of a narrative: The budget proposed by the Board of Supervisors has no narrative. There is no explanation of the local, state, and national context in which the budget was developed or any explanation of drivers or assumptions. Instead, the budget is one long spreadsheet.The Wyoming Association of Municipalities aptly describes (PDF) the value of the narrative; see the image to the right. The organization also urges members to assess their budget document by asking four questions:

- Is the budget message informative and easy to read?

- Does the budget message address major issues, including public concerns?

- Does the budget document include an overall mission statement?

- Does the budget message include specific goal statements?

Lack of metrics: The budget proposed by the Board of Supervisors contains no data about anticipated service levels. This makes assessing the adequacy of budget categories and activities next to, if not entirely, impossible.

$ .02 increase in the real estate tax rate: With the increase, the General Property Taxes revenue is $19 million, a 707,125 or 3.85% increase over the approved FY 2017 revenue of $18.4 million. By comparison, the FY 2017 budgeted revenue was $1.2 million, or 7%, greater than the FY 2016 actual revenue of $17.2 million.

Several questions should be asked about this revenue source:

- How much of the increase between FYs 2017 and 2018 is from the $ .02 increase?

- Does the county require this increase since the assessed value of taxable property is likely still below the FY 2007 value of $2,829,613,762? (In FY 2016, the value was $2,810,608,837.) (FY 2016 audit (PDF))

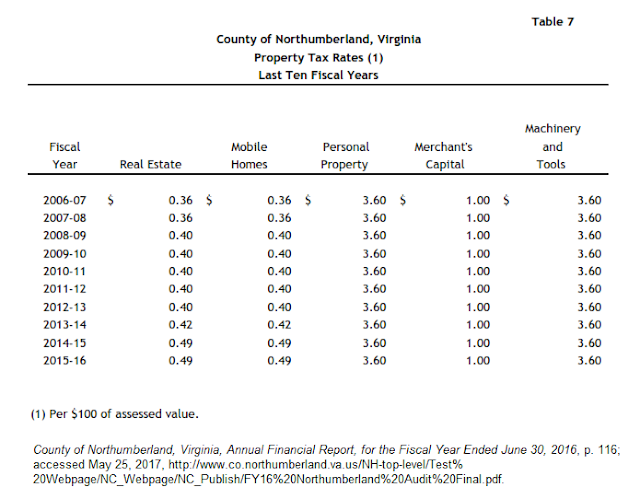

- Does the Board have a policy for keeping level/increasing the rate? As is shown in Table 7 Property Tax Rates Last Ten Fiscal Years, below, there doesn't seem to be a pattern for real estate property tax.

Contract with the YMCA: The YMCA requested an additional $50,000 for FY 2018, bringing their total contract with the county to $100,000. With no narrative, there is no explanation of what this money will do for county residents.